Background

One of the most visible consequences of a warming world is an increase in the intensity and frequency of extreme weather events, resulting in increased costs and the inability to access insurance in “high risk” areas.

In the event of a large-scale natural disaster, the Government of Canada provides financial assistance to provincial and territorial governments through the Disaster Financial Assistance Arrangements (DFAA), administered by Public Safety Canada (PS).

Insurance companies are raising premiums as a result of elevated claims in the past couple of years, due to climate change. This is a continuation of a trend in the insurance industry of what experts call a “hardening” of the insurance market. There is an opportunity for the DFAA program to tackle this global issue in an innovative and responsible manner.

Through the DFAA, assistance is paid to the province or territory – not directly to affected individuals, small businesses or communities.

Since the inception of the program in 1970, the Government of Canada has contributed more than $6 billion in post-disaster assistance to help provinces and territories with the costs of response and of returning infrastructure and personal property to pre-disaster condition.

A recent report released by the United Nations, confirms that climate-related disasters jumped 83 percent — from 3,656 events during the 1980-1999 period to 6,681 in the past 20 years[1].

Natural Resources Canada released a new report that attempts to address a question that’s being asked with more and more frequency: what is the economic impact of climate change? In 2020, severe weather caused $2.4 billion in damage in Canada, the fourth highest on record in nearly four decades[2]. Over the past 40 years, a Public Safety Canada report from 2020, estimated that damages from extreme weather events in this country has cost the economy roughly $31 billion[3].

Insurance works by pooling together the resources of a large number of people who have similar risks into a “collective pot”. Single individuals in this arrangement can make larger withdrawals than they paid into the pot if they experience a major event and need coverage.

The key thing to be aware of is that, in any given year or region, If more money is coming out of the “collective pot” through claims, or less people are putting money into the pot (deciding not to buy insurance), then the amount of money the remaining individuals need to put into the pot (premiums) has to go up. Otherwise, the system isn’t sustainable and insurance providers can’t offer coverage without going out of business.

As climate change increases the frequency and intensity of natural disaster events, insurance has become a growing challenge for communities in “high risk” areas.

Between 2009 and 2020, Canadian insurers spent an average of $2 billion annually on losses related to natural catastrophic events —this is in excess of a 400% increase when compared to the annual average paid out from 1983 to 2008, according to the Insurance Bureau of Canada (IBC).

Insurance companies are raising premiums due to these elevated claims. This is a continuation of a trend in the insurance industry of what experts call a “hardening” of the insurance market. This occurs when there is high claims activity and policies are harder to come by. We’ve been in a hardening market since 2019 due to these issues.

Increased risk tied to climate change can also affect the supply of insurance available given market. As insurers weigh their risk exposure globally, they may pull out of “high risk” areas, which can result in decreased competition, higher prices and less choice for both homeowners and businesses needing insurance. This can lead to areas in the province where insurance simply unavailable.

One challenge with a program such as DFA, is that one does not want to create an incentive for individuals to not purchase insurance coverage, because they know they have DFA as a fall-back for “free”. The result, as discussed earlier, is that as less people purchase insurances, the premiums for the remaining individuals increases and becomes more difficult to access. This is a self-fulfilling snowball effect which will only make the situation worse.

Countries around the world are trying to tackle this same issue and are implementing a wide variety of approaches ranging from private or public insurance which is either voluntary or compulsory. Every possible combination of these options is in force somewhere.

The experience in other countries, particularly the United Kingdom and the United States, suggests that the solution is for insurance in high-risk areas to be subsidized—either by low-risk policy holders, as in the United Kingdom, or by government, as in the United States.

In BC we are starting to see the results of these scenarios, where insurance has become so costly in some areas that many households and businesses opt to do without. This issue could be addressed by making insurance coverage uptake high as possible in areas of high risk. This would result in lower overall premiums for everyone living in these high risk areas. This could be achieved through the development of a government grant program for homeowners in high-risk areas to help offset the high cost of insurance and incentivize individuals to purchase it. This grant program could be something akin to the BC Home Owner Grant.

Although a grant program such as this would cost government funding dollars, it would also offset the costs associates with DFA payouts.

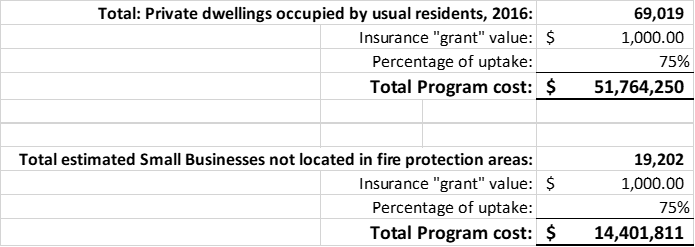

Referencing the latest Statistics Canada Census data (2016), focusing on private dwellings in BC, specifically the numbers of dwellings which are “occupied by usual residents” (not recreational properties), we get a sense of the number or primary dwellings in BC.

This data can be subdivided it by “Census subdivision type” which enables us to eliminate Cities, District municipalities, Towns and Reserves – which are virtually all covered by some fire protection or are Federal property. In theory this leaves us with a good estimate for the number of dwellings which do not have fire protection (some of these areas could have fire protection, but we will leave them in to be conservative).

If we then assume a 75% program uptake and a grant of $1,000 per dwelling – which should cover a substantial portion of a fire insurance policy.

Here is a summary of the calculations:

THE CHAMBER RECOMMENDS:

That the Federal Government

- Update the DFAA Program, to allow Provinces and Territories to apply for funding to create a new grant program for homeowners in high-risk areas to help offset the high cost of insurance and incentivize individuals to purchase it.

Submitted by the Kamloops and District Chamber of Commerce

[1] UN Office for Disaster Risk Reduction: The Human Cost of Disasters 2000-2019 (2020)

[2] Natural Resources Canada: Canada in a Changing Climate: National Issues Report (2021)

[3] Public Safety Canada (2020). Critical infrastructure. Retrieved February 2020, from: https://www.publicsafety.gc.ca/cnt/ntnl-scrt/crtcl-nfrstrctr/index-en.aspx