Approved by Kamloops & District Chamber of Commerce members at the March 14th Public Policy Debate

Issue

As the Immediate Expensing Incentive program expires, two competing national crises cry for new private capital investment.

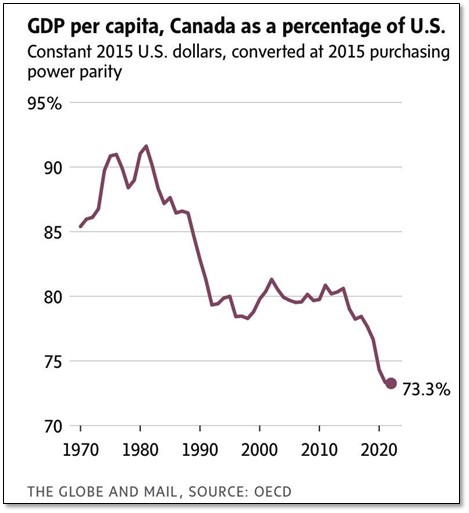

- Canadian productivity is tanking. As The Globe and Mail recently reported, “Per capita GDP, after adjusting for inflation, is now below where it was in the fourth quarter of 2014, nine years ago.”[1]

Chart 1 – GDP per capita, Canada as a percentage of U.S.

Source: The Globe and Mail

- Healthcare wait times are bad and getting worse. The median wait time from GP referral to treatment has increased by 198% since 1993 to 27.7 weeks.[2] Healthcare spending represents 12.1% of the 2023 nationwide GDP[3], but that’s not enough; our surging/aging population is driving the country toward a massive investment deficit in healthcare diagnostics and delivery facilities.

Background

Private clinics deliver essential, publicly funded medical services across Canada. Rather than disrupting the single-payer system, private investment facilitates flexible and timely responses to evolving healthcare demand. For example:

- OHIP-funded MRIs, CT scans, GI endoscopies, orthopedic surgeries, and cataract surgeries are offered at more than 900 private clinics in Ontario.[4]

- 4% (13,000) of publicly funded surgeries in BC are performed at private clinics.[5]

- Among private clinics in Canada, public funding supports 29.5% of MRI scans and 64.7% of CT scans[6] (MRIs have fewer private-pay constraints in some provinces).

- Although more than half of all long-term care homes in Canada (54%) are privately owned,[7] ~75% of the beds they contain are publicly funded.[8]

In 2021, the federal government introduced the Immediate Expensing Incentive “…to provide a temporary accelerated deduction to encourage investments by small and medium-sized Canadian businesses and thereby accelerate the economic recovery while supporting productivity growth in the longer term”[9] to a limit of $1.5 million. This temporary incentive expired December 31, 2023, for Canadian Controlled Private Corporations, and will expire December 31, 2024 for individuals and Canadian partnerships all the members of which are individuals.

Canada’s Drug and Health Technology Agency indicates the country has experienced a net “1.5% decrease in the total number of medical imaging units over the last 10 years…” which leads “…to delays in patient diagnosis and treatment.”[10]

Dr. Gilles Soulez[11] – president of the Canadian Association of Radiologists (CAR) – estimates “…the economic impact of longer medical imaging wait times (are) in the range of $3.5 billion in terms of lost GDP, due in part to people ending up in need of more urgent, more invasive care or not being able to work while they wait.” The CAR projects that an investment of $1 billion for new medical imaging equipment is required over the next three years.

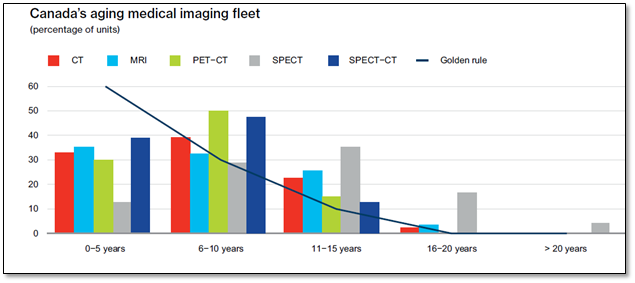

According to the European Coordination Committee of the Radiological, Electromedical and Health IT Industry (and as cited by the Canadian Agency for Drugs and Technologies in Health) there are three “golden rules” used to assess the capacity of medical imaging stock to meet the demands of a health care system:

- At least 60% of imaging equipment should be five years old or less.

- No more than 30% of imaging equipment should be between six and 10 years old.

- No more than 10% of imaging equipment should be older than 10 years.

In Canada, the age of the imaging fleet has turned these targets upside-down. Despite heavy public spending (at 33%+ of budget, healthcare is the single largest budgetary item across all provinces), 66% of the fleet is more than five years old, and a full 27% is essentially aged-out at 11+ years (as illustrated below).[12]

Chart 2 – Canada’s aging medical imaging fleet

Source: The Conference Board of Canada.

More investment is required to reduce wait times, improve outcomes, and streamline productivity not among only healthcare delivery organizations, but also among the patients they serve, insofar as eliminating bottlenecks will allow patients to be diagnosed and treated more promptly so they can get back to work. As Dr. Daniel Jenkin, past president of the General Surgeons of B.C. explained in 2023, “People cannot even access a surgical waitlist until they get off a radiology waitlist, it’s a huge bottleneck.”[13]

New capital investment will not solve all factors contributing to the bottleneck, but it will help. Acquisition and retention of skilled human resources is a challenge. Additional technologists and support staff are and will be needed. Burnout is a persistent threat which is aggravated by aging equipment and overtaxed technology platforms. Providing technologists with new equipment that reduces downtime, improves efficiency, and facilitates better/more timely patient outcomes will enhance workplace satisfaction, thereby improving opportunities to acquire and retain skilled technologists.

We encourage all levels of government to incentivize private investment for capital expenditures like diagnostic imaging systems, operating theaters, and mobile clinic infrastructure. And while eligible businesses are currently able to claim up to a total of $1.5 million in tax depreciation via the Immediate Expensing Incentive, the average cost for new MRI and CT machines is ~$2 million. It is not unusual for clinics to operate multiple diagnostic imaging systems.

The Chamber Recommends

That the Federal Government:

- Recommit to the Immediate Expensing Incentive for a minimum of 5 years.

- Expand the Immediate Expensing Incentive to $5 million in total per year when used to purchase new diagnostic imaging systems, operating theaters, and mobile clinic infrastructure.

Submitted by the Kamloops and District Chamber of Commerce

[1] Coyne, Andrew. 2024. Canada Is No Longer One of the Richest Nations on Earth. Country after Country Is Passing Us By. The Globe and Mail. The Globe and Mail. March 1, 2024. https://www.theglobeandmail.com/opinion/article-canada-is-no-longer-one-of-the-richest-nations-on-earth-country-after.

[2] Waiting Your Turn: Wait Times for Health Care in Canada, 2023 Report. 2023. Fraser Institute. Fraser Institute. December 7, 2023. https://www.fraserinstitute.org/categories/health-care-wait-times.

[3] National Health Expenditure Trends. 2023. Canadian Institute for Health Information. Canadian Institute for Health Information. November 2, 2023. https://www.cihi.ca/en/national-health-expenditure-trends.

[4] Ontario Preparing for next Step in Private Clinic Expansion. 2024. CBC Toronto. CBC Toronto. January 17, 2024. https://www.cbc.ca/news/canada/toronto/ont-private-clinics-1.7086744.

[5] $393M in Contracts given to Private Health-Care Clinics in B.C. Over 6 Years, Report Finds. 2022. CBC British Columbia. CBC British Columbia. August 24, 2022. https://www.cbc.ca/news/canada/british-columbia/ccpa-report-health-care-contracts-1.6561119.

[6] Use of MRI and CT in Private Imaging Facilities in Canada (2021-2023). 2023. Canadian Journal of Health Technologies. Canadian Journal of Health Technologies. October 2023. https://canjhealthtechnol.ca/index.php/cjht/article/view/CM0010/1616.

[7] Long-Term Care Homes in Canada: How Many and Who Owns Them? 2021. Canadian Institute for Health Information. Canadian Institute for Health Information. June 10, 2021. https://www.cihi.ca/en/long-term-care-homes-in-canada-how-many-and-who-owns-them

[8] Ensuring Quality Care for All Seniors. 2018. Canadian Health Coalition. Canadian Health Coalition. November 2018. https://www.healthcoalition.ca/wp-content/uploads/2018/11/Seniors-care-policy-paper-.pdf.

[9] “Government of Canada – Accelerated Investment Incentive.” Canada.ca, November 27, 2023. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/report-business-income-expenses/claiming-capital-cost-allowance/accelerated-investment-incentive.html.

[10] R The Canadian Medical Imaging Inventory: 2022–2023. 2023. Canada’s Drug and Health Technology Agency . Canada’s Drug and Health Technology Agency . December 7, 2023. https://www.cadth.ca/sites/default/files/hta-he/HC0024_cmii_2022_2023_evidence_preview.pdf.

[11] Daniel, Dianne. 2023. Hospitals and Imaging Centres Are Grappling with DI Backlogs. Canadian Healthcare Technology. Canadian Healthcare Technology. February 7, 2023. https://www.canhealth.com/2023/02/07/hospitals-and-imaging-centres-are-grappling-with-di-backlogs.

[12] Sutherland, Greg, Nigel Russell, Robyn Gibbard, and Alexandru Dobrescu. 2019. The Value of Radiology, Part II. The Conference Board of Canada. The Conference Board of Canada. June 2019. https://www.conferenceboard.ca/wp-content/uploads/woocommerce_uploads/reports/10328_The-Value-of-Radiology_RPT.pdf.

[13] Daflos, Penny. 2023. Radiologists Warn “Dangerously Long” Wait Times Could Worsen as B.C. Clinics at Risk of Closure. CTV Vancouver. CTV Vancouver. June 19, 2023. https://bc.ctvnews.ca/radiologists-warn-dangerously-long-wait-times-could-worsen-as-b-c-clinics-at-risk-of-closure-1.6447831.